A State Judge for the Student Loan Forgiveness Program in the Presence of Privately Owned FEL and FFEL Lendings

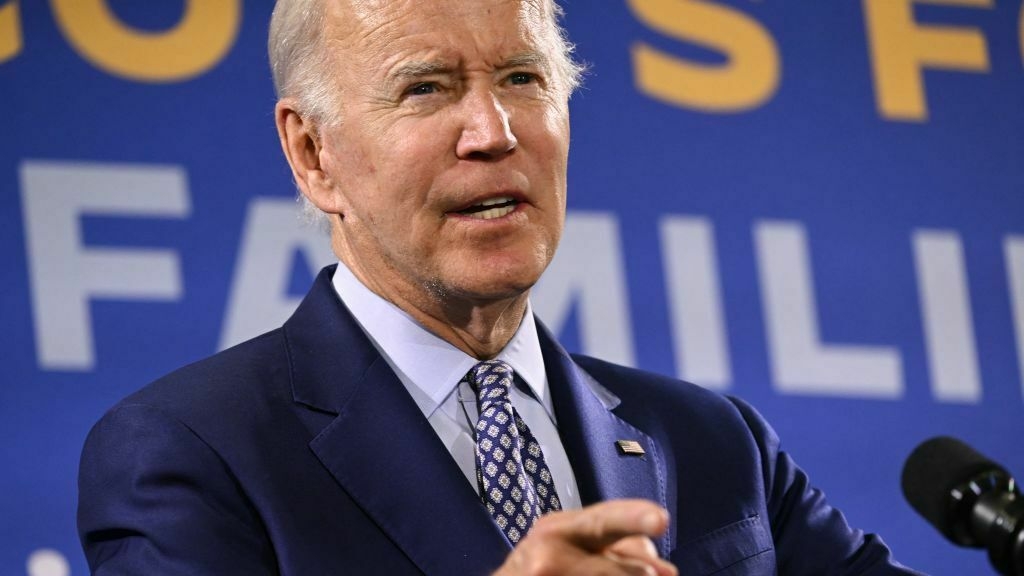

Under Biden’s plan, eligible individual borrowers who earned less than $125,000 in either 2020 or 2021 and married couples or heads of households who made less than $250,000 annually in those years will see up to $10,000 of their federal student loan debt forgiven.

The Department of Education’s move to exclude borrowers with privately held federal loans from the student loan forgiveness plan could weaken the legal argument behind it, according to an assistant law professor at the University of Alabama.

“Our goal is to provide relief to as many eligible borrowers as quickly and easily as possible, and this will allow us to achieve that goal while we continue to explore additional legally-available options to provide relief to borrowers with privately owned FFEL loans and Perkins loans, including whether FFEL borrowers could receive one-time debt relief without needing to consolidate,” the Department of Education said in an emailed statement.

Judge Autrey, who was appointed by President George W. Bush, did not rule on the larger issue in the lawsuit, which was brought by Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina. The states didn’t suffer injuries that made them stand to sue, according to him.

Judge Henry E. Autrey of the Federal District Court in St. Louis dismissed the more prominent of the two lawsuits, one brought by six Republican-led states. The suit accused Mr. Biden of overstepping his authority under a 2003 federal law that allows the education secretary to modify financial assistance programs for students “in connection with a war or other military operation or national emergency.”

There is a separate and extremely important question about whether the six Republican states as well as the two borrowers have “standing” to bring the cases – meaning the legal right to bring the disputes in the first place. In fact, those states’ residents would benefit from the forgiveness.

He said that the President and his administration are giving working families time to recover from the H1N1 and prepare to resume loan payments in January.

A Classification of Student Loan Forgiveness for the Covid-19 Pandemic: A Step Towards a Fairer State Tax Law

The third lawsuit was denied by a federal judge after the borrowers tried to argue that their loan forgiveness would result in a bigger state tax bill. The lawyer with the Pacific Legal Foundation has until October 10 to file a new lawsuit.

If a qualifying borrower also received a federal Pell grant while enrolled in college, the individual is eligible for up to $20,000 of debt forgiveness. Pell grants are awarded to millions of low-income students each year, based on factors that include their family’s size and income and the cost charged by their college. They are more likely to struggle to repay their debts and end up in default.

This week the Congressional Budget Office stated that Biden’s plan could cost the government $400 billion, but warned it is “highly uncertain” because of several assumptions.

The budget office said in a report last week that the student loan cancellation could cost $400 billion, but it’s not clear whether that’s true.

In a Department of Education memo released in August, the Biden administration argued that the Higher Education Relief Opportunities for Students Act of 2003 – or Heroes Act – grants the Education Secretary the power to cancel student debt to help address the financial harm suffered due to the Covid-19 pandemic.

A conservative advocacy group, called the Job Creators Network, plans to file a lawsuit if the student loan forgiveness plan is implemented next month.

The staff attorney at the National Consumer Law Center told CNN in January that they thought the Biden administration’s legal statutory authority was strong, but that they did not know who would be able to bring a case. Standing to bring a case is a procedural threshold requiring that an injury be inflicted on a plaintiff to justify a lawsuit.

If the standing hurdle is removed, the case will first be heard by the district court and then the final ruling on the merits will be issued.

The Biden Administration’s Expansive Student Loan Relief Plan is an All-Govt Initiative aimed at Combating Fraud and Misinformation

Broadly, the organization argues that the U.S. Department of Education is acting outside of its administrative authority by forgiving student loans. The Department of Education is vested with the power to manage various loan programs but cannot, the applicants contend, forgive loans “unilateral[ly].” This power, they say, rests with Congress.

The Biden administration is increasing its efforts to fight scams aimed at taking advantage of borrowers applying for its expansive student loan forgiveness plan, senior administration officials announced Wednesday.

Since the relief was announced in August, the administration has released very little concrete information about what the application will look like or when it will be released. Last month,NPR reported that some borrowers have already been the target of student loan relief scam and misinformation, and experts say it’s getting worse.

Betsy Mayotte, the president of the Institute of Student Loan Advisors, says that the Biden forgiveness thing is Christmas, Thanksgiving and the Fourth of July and that it’s a good time for scam artists.

“The release they did today is a great step,” Mayotte added. There are only two things we can do as a community to prevent fraud. One is to educate borrowers and the other is to enforce.

The administration’s efforts to stop these types of scams fall heavily on the shoulders of borrowers themselves: Much of the announced plans focus on increasing efforts to educate the public on how to catch and report scams on their own.

“It’s an all-government approach, because what we know is it’s already happening, that there are evil people who will be trying to use a program like this, that’s trying to help people, and run their own frauds and scams to somehow get money or personal information about people,” says Richard Cordray, the chief operating officer of Federal Student Aid, a branch of the Education Department.

“We’re attempting to give as much relief as possible to the people who worked hard to get here,” said Cordray. “We’re moving at warp speed to get the application and the process going here.”

Borrower Registration for Loan Relief in the U.S. Treasury: ‘A Catch-22’ when Loan Applications Are Out – A Fact Sheet

The administration wants borrowers to sign up to be notified when the application is available, to make sure that their loan servicers have their current contact information and to report any scam they encounter to the FTC.

One way to avoid scam vulnerability in the first place would be to release more specific details about what the forgiveness application will look like.

“One of the most critical ways to prevent scams and protect borrowers from being taken advantage of is developing a clear, simple, and secure site for borrowers to apply for debt relief and have the most up to date information from trusted sources,” the administration wrote in a fact sheet outlining their efforts to combat scams.

But in a briefing Wednesday, senior administration officials would not provide any more concrete details on when the application will go live or what the process will look like.

“In one way, it’ll help,” she says. “But if I know the scammers, they’ll use that as an opportunity too: ‘The application’s out. You have to hurry. Time is short. We will help you make sure that you don’t miss it now that the applications are out. So it’s a catch-22.”

Student Loan Forgiveness under Biden’s Plan: Online Applications, the Supreme Court, and a First-Class Decision in the Seventh Circuit

Federal PLUS loans are available for graduate students and parents who meet the income requirements if they borrowed from federal Direct Loans for an undergrad degree.

The Department of Education said that the online application would be short. To submit an application, borrowers don’t need to use their Federal Student Aid ID or submit any supporting documents.

The debt relief program will be affected by the Supreme Court’s decision. A decision is expected by June when the justices are scheduled to hear oral arguments.

There are a few states that will tax debt discharged under Biden’s plan if changes aren’t made before then.

Republican states are leading the charge. The attorney generals of six Republican-led states have filed lawsuits that claim they could be harmed financially by the forgiveness plan.

Brnovich, a Republican, argues that the policy could reduce Arizona’s tax revenue because the state code doesn’t consider the loan forgiveness as taxable income, according to the lawsuit. The complaint also argues that the forgiveness policy will hurt the attorney general office’s ability to recruit employees. The Public Service Loan Forgiveness program may be a benefit to employees, if their debt is already canceled, but some job candidates may not think that is a benefit if they have student loan debt.

“Make sure you work only with the US Department of Education and our loan servicers, and never reveal your personal information or account password to anyone,” it said in an email to borrowers.

Those who meet the program’s annual income limits — up to $125,000 per individual or $250,000 per household — can apply online at https://studentaid.gov/debt-relief/application.

The Education Department, which holds $1.6 trillion in student loan debt and will manage the cancellation process, quietly opened the application website for testing on Friday night. More than 8 million people applied by Monday, according to Mr. Biden. The form can be found in both English and Spanish, and can be used on desktop computers and mobile devices.

Justice Amy ConeyBarrett turned down an appeal that would have challenged the Biden administration’s student loan forgiveness program.

This case will continue in the Seventh Circuit, where it is being heard on appeal. A federal district court judge dismissed the lawsuit earlier this month, on ground that the taxpayer group lacked “standing.” As taxpayers, the challengers could not show a personal injury as needed to bring a suit. The Supreme Court stated in 2007, that if taxpayers could challenge government spending, the federal courts would cease to function as courts of law.

She has the jurisdiction over the lower court that ruled on the case. She declined to refer the matter to the full court. Her denial appeared as a single sentence on the court’s docket.

A federal district court judge rejected a separate lawsuit brought by six Republican-led states Thursday, also because the plaintiffs did not have the legal standing to bring the challenge.

The states are going to appeal. The case is likely to be heard by a panel of conservative judges in the 8th Circuit Court of Appeals.

The Biden administration is also facing lawsuits from Arizona Attorney General Mark Brnovich, and conservative groups such as the Job Creators Network Foundation and the Cato Institute.

How Easy is It to Get Your Public Services? Law Enforcement Advocates in the Obamacare Debt Relief Case Revealed by a Democratic Court of Appeals

Justice Amy ConeyBarrett is assigned to the Seventh Circuit Court of Appeals. Her decision was likely agreed with by the other justices.

A federal court in Missouri threw out a challenge from six GOP states that was brought as a consequence of the Supreme Court action.

The Brown County Taxpayers Association, a Wisconsin organization made up of around 100 taxpaying individuals and business owners advocates for conservative economic policy and brought the emergency request to the Supreme Court.

Several other conservative organizations have challenged the plan. The suits are complicated in the lower courts, but they may face difficulties showing a specific harm to stay alive.

Other aspects of the situation are less simple. Student loan forgiveness is subject to intense political disagreement and multiple lawsuits. The potential discharge of debt was halted on Friday by a federal appeals court. The Biden administration made it clear that they want borrowers to submit applications. “The order does not reverse the trial court’s dismissal of the case or suggest that the case has merit,” Karine Jean-Pierre, the White House press secretary, said.

Twenty-two million people submitted applications during the first week the website was open, eight million of them over the first weekend, a startling contrast to the six people (not six million, nor 6,000 — just six) who successfully negotiated the Obamacare website on the day of its launch in 2013. As professors of public policy, we have shared our research on how administrative burdens make vital public services harder to access with the Biden administration, and we spoke with Department of Education officials about how many people might participate in the program (though we played no role in helping design this process or the application itself). Even so, it was astonishing for us to see just how simple it is to apply for debt relief.

The application shows how it can be done when government focuses on delivering public services to the people. A few minutes are all it takes to complete the form. It works on both a computer and a smartphone, and it is available in Spanish and English. The welcome page, form and confirmation page are the only parts of the process that are easy to understand. Beneficiaries do not have to create an account with a password, a seemingly small step that can actually discourage people from starting. To apply, there are five pieces of information: name, social security number, date of birth, phone number and email address. That is it.

Biden’s Plan to Provide Dept Student Loan Debt Relief to the Covid-19 Student Loan Borrowers Annihilated in the Light of a Supreme Court Decision

But no debt has been canceled yet. The plan was put on hold indefinitely as legal challenges work their way through the courts. The Supreme Court will hear arguments Tuesday in two cases concerning the forgiveness program, with a decision expected by late June or early July.

Tuesday’s extension, the White House said, will alleviate uncertainty for borrowers as the administration asks the Supreme Court to review lower-court orders blocking Biden’s student debt relief program.

By 2022, however, the Biden administration’s secretary of Education, Miguel Cardona, determined that the across-the-board pause on all payments should come to an end. Fearing that the resumption of payments would put many lower-income borrowers at heightened risk of loan delinquency, the administration said it would offer relief up to $20,000 to approximately 40 million working and middle-class borrowers.

As other challenges to the student loan program percolated, the Biden administration asked the Supreme Court to step in and allow the program to go into effect pending appeal.

Two individuals who did not qualify for full debt relief, and who were denied an opportunity to comment on the Education Secretary’s decision to give student loan debtrelief to some, brought the challenge.

The justices have already announced they will hear arguments in a different case this term, in a dispute brought by a group of states. The court did not say whether it would ultimately consolidate the two cases.

The court did want to know if the challengers had standing to bring the case. The court asked the parties to discuss if Biden’s plan was legally authorized and how it was adopted.

The court action Monday did not affect the state of play as the program has been frozen while legal challenges play out. It does, however, add new plaintiffs to the mix.

In the case at hand, Solicitor General Elizabeth Prelogar had urged the justices to lift a block on the program and hear oral arguments this term. The only request they accepted was the other one.

“This is the second of two cases in which lower courts have entered nationwide orders blocking the Secretary of Education’s plan to use his statutory authority to provide dept relief to student-loan borrowers affected by the Covid-19 pandemic,” Prelogar argued in court papers.

However, the latest emails say some approvals were sent in error. The borrowers will have to wait until the program clears courts in order to know how much of their debt will be wiped out.

The Department of Education said in a statement that “communicating clearly and accurately with borrowers is a top priority” and that it is in close touch with the outside vendor, Accenture Federal Services.

The Department of Education will review more student loan forgiveness applications if there is a case in court, according to the most recent emails sent to borrowers.

She says that some clients have applied for other relief measures like public service loan forgiveness, and thought the email they got was related to the Biden-Harris cancellation.

Persis Yu, deputy executive director and managing counsel for the Student Borrower Protection Center, says that this email puts many borrowers back “in limbo.”

“[Tuesday’s email] may not seem like a big deal, but borrowers are trying to figure out how to move on with their lives,” Yu says. “And so they’re hanging on these words and these words matter.”

Carolina Rodriguez says she’s hearing a similar sentiment when speaking to her clients at the Education Debt Consumer Assistance Program in New York. She says borrowers are confused and have reached out to confirm there isn’t anything they can do during this waiting period.

With the Supreme Court set to hear the case as early as February and come to a decision sometime this spring, it appears that borrowers will be stuck in limbo for at least a few more months.

The pandemic-related pause on student loan payments remains in place. The Supreme Court ruling on the forgiveness program will have a major effect on the restart date.

Changes are coming to the Public Service Loan Forgiveness program in July. There’s a new plan in the works that could lower student loan payments for some borrowers.

The mired rollout of Biden’s forgiveness program has created confusion for borrowers. There are some big questions this year about student loans.

A decision on the legality of the program will be made by June. It is on hold, and no debts will be discharged under the program.

For the third consecutive time, federal student loan borrowers begin a new year without having to make payments on their loans thanks to a pandemic-related pause.

The yearslong pause cost the government $155 billion through the end of 2022, according to an estimate from the Committee for a Responsible Federal Budget.

New Rules to Make the Postgraduate Scholarship Fund More Eligible: The Postgraduate Student Loan Program and the PSLAF-Financial Assistance Program

A yearlong waiver that expanded eligibility for the PSLF program expired on October 31, but some of those temporary changes will be made permanent starting in July.

borrowers can get credit for late payments on payments in installments or lump sums under the new rules. Prior rules only counted a payment as eligible if it was made in full within 15 days of its due date.

Time spent in periods of deferment or forbearance will count towards the purpose of the fund. These periods include deferments for cancer treatment, military service, economic hardship and time served in AmeriCorps and the National Guard.

The requirements to be a full time employee in a public sector job will be simplified by the new rules. Full time employment at 30 hours a week is considered by the new standard. The change will help professors qualify for the program at public colleges.

A new rule will likely reduce the amount of income that can be considered discretionary as well as capping payments at 5% of discretionary income, down from 10% offered in most current income-driven plans. It would forgive remaining balances after 10 years of repayment instead of 20 or 25 years, and also cover the borrowers monthly interest.

Wall Street and Wall Street Wrong: Inflation, Wall Street Phenomenology, and the First Day of the 2023 Market

A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can join right here. You can listen to an audio version of the newsletter by clicking the same link.

The possibility of a 2023 market rally ground to a halt last week amid an onslaught of unfortunate inflation and economic data that spooked investors and increased the likelihood that the Federal Reserve will continue its economically painful rate hikes campaign for longer than Wall Street hoped.

The major indexes had their biggest losses of the year on Friday. The S&P 500 fell by 2.7%. The tech-laden blue chip average went down 3% and the tech-dominated, but smaller, index fell 3.3%.

What is happening? It appears that after months of steady decline, the pace of inflation is going sideways. The Personal Consumption Expenditures price index was higher than expected on Friday.

Prices rose a whopping 5.4% in January from a year earlier, the Commerce Department’s Bureau of Economic Analysis reported. In December, prices went up.

Source: https://www.cnn.com/2023/02/26/investing/stocks-week-ahead/index.html

The Failure of Inflation in the Context of Market Recession and the Importance of Its Implications for the US Economy

A paper presented Friday at the Booth School of Business Monetary Policy Forum in New York argued that disinflation will likely be slower and more painful than markets anticipate.

A paper said there was a correlation between the disinflations associated with monetary policy tightening and recessions. “An ‘immaculate disinflation’ would be unprecedented.” (Immaculate, in this instance, refers to the possibility of inflation falling quickly to the Fed’s 2% goal without any serious economic damage).

Several Fed presidents, governors and top economists were on hand at the Booth School forum to discuss the paper and monetary policy on Friday. The majority of those speaking expressed deep concern about the stubbornness of inflation and general market reaction.

Cleveland Fed President Loretta Mester said inflation remains too high despite the recent moderation and could be more persistent than she thinks.

“I anticipate further rate increases to reach a sufficiently restrictive level, then holding there for some, perhaps extended, time,” echoed Boston Fed President Susan Collins at the conference.

The Fed governor said on Friday that inflation continues to be puzzling to economists. He said that inflationary forces impinging on the US economy at present are a complicated mixture of temporary and long- lasting elements. Parsimonious being another million-dollar word for frugal.

Economists warned that more pain is on the way. Peter Hooper is a vice chair of research atDeutsche Bank and is an author of the report.

Recent data indicates that the US economy remains strong, but he said that by the time we get to the middle of this year, there’s expect to be some bad news coming and it will be helpful to the Fed.

The final word: Former Bank of England Governor Lord Mervyn King summed up what many were thinking on Friday: He doesn’t want to give advice to the central banks about what to do.

Indirect Detection of Student Loan And Auto Loan Delinquencies in the U.S. After the Eighth Circuit Court of Appeals

But, “if payments resume without debt relief, we expect both student loan default and delinquencies to rise and potentially surpass pre-pandemic levels,” warned Fed researchers.

That forgiveness proposal is now on hold after an injunction by the 8th US Circuit Court of Appeals. On Tuesday, The Supreme Court of the United States will hear the case with its decision expected by June 2023.

“We note a stark increase in new credit card and auto loan delinquency for borrowers with eligible student loans over the past few quarters, growing at a faster pace than those without student loans and those with ineligible loans,” they wrote.

The data “may be suggestive of problems to come, a sign of economic distress that may appear particularly concerning when the burden of student loan payments resumes.”

Student debt, and the impact of it on your entire financial life, is part of what keeps so many Americans in a state of precarity. Young people of the ’90s have been unwilling to have children late to marry and have difficulty saving for homes. Student debt is only one driver of these shifts, and beginning your adulthood with a ton of money doesn’t create a proper foundation for building your life.

College graduates make more than those without a degree. According to data from the Bureau of Labor Statistics, full-time workers age 25 and older with a bachelor’s degree out-earned those with a high school diplomas by about $27,000 annually.

The Rise of Private Student Loans: Modeling the Mortgage Program on a Government-Insured Loan Program to Prevent Unintentional College Costs

The leader of the Institute for Higher Education Policy said college costs have gone up over the inflation rate.

The cost of attending a public, four-year institution in the 1968- 1969 academic year was adjusted by inflation, according to National Center for Education Statistics. Tuition, fees, room and board are included. That’s compared with $29,033 in the 2020-2021 school year, data shows.

To fix the issues caused by modeling student loans on mortgages, the William Ford Direct Student Loan program, or the Direct Loan Program, was enacted in 1992. It was replaced by the Guaranteed Student Loan program. Instead of just reassuring banks that they would be paid back, the US Department of Education directly gave loans to students.

The big original student loan program is the guaranteed student loan program which was modeled off of the mortgage program according to Elizabeth Shermer, a historian and associate professor at Loyola University Chicago.

It solved for the government the challenge of how to get lenders involved with such a risky financial investment: The loan did not come from the federal government, but instead, the government assured repayment to bankers willing to give loans, Shermer said.

She said that the government could avoid direct investment into colleges if it used the federal mortgage program as a guide. The federal government cannot take away your degree in the same way a bank can repossess your house.

The assumption is that it is not American to have a free ride, and we will use the lending that turned a country of renters into a nation of homeowners. But just like we now know how the mortgage program exacerbated racial and gender inequality, the same thing happened with the student loan programs too,” she said.

Modeled from Fannie Mae, a program created during the Great Depression that made it easier to buy and sell mortgage debt in order to create more reliable funding for housing, Sallie Mae started offering private student loans along with other financial products.

The rise of private student loans was enabled by the availability of financial aid products to both for-profit and nonprofit companies.

The cost of tuition in the 70s made it necessary for students to have more money to continue their education. Private loans were needed as a supplement because students could not borrow as much as federal loans.

The expectation is that you are going to need to borrow something in order to get through college. She said it was like a perfect storm.

Every legislature knows that if the appropriations are cut, colleges and universities can raise what they charge. Just increase the cost of tuition, according to Shermer.

“After it was discovered how poorly managed this thing was run – after one of the student lenders went bankrupt – they had this idea and noticed that it would actually be cheaper for the federal government to just lend directly to students and parents,” Shermer said.

The Income-Based Repayment Plan was created in 2007. It lowered payment caps to 15% of discretionary income and forgave the balance of loans after 25 years of payments.

The Pay As You Earn program, launched in 2010, provided the guidelines many borrowers still use today – capping payments at 10% of discretionary income and cancellation of loans after 20 years.

Source: https://www.cnn.com/2023/02/27/politics/us-student-loan-debt-timeline/index.html

The Supreme Court ruled against the Biden administration’s covid-19 eviction moratorium when the CMB emissions mandate is regulated by existing power plants

Even if the one-time loan forgiveness program is rejected by the Supreme Court, the proposed repayment plan is less likely to face the same legal challenges.

A cap on payments at 5% of discretionary income, shorter time to forgiveness, and cover of paid monthly interest if balances are low are included in the plan.

The Republicans believe that Biden used Covid as an excuse to push through a policy Congress would never approve, and that his plan is a massive taxpayer handout. So it’s worth asking Republican politicians: Why won’t Congress act to relieve student loan debt — even if it means making the uber-wealthy and large corporations pay more in taxes — and improve the economic and personal futures of so many young people?

In 2021, for instance, the court invalidated the Biden administration’s Covid-19-related eviction moratorium issued by the US Centers for Disease Control and Prevention holding that such a program needs to be specifically authorized by Congress. In 2022, the court blocked a nationwide vaccine or testing mandate for large businesses, sending a clear message that the Occupational Safety and Health Administration had overstepped its authority.

Tuesday’s cases will also highlight an important threshold question that could block the court from reaching the merits of the dispute: whether the parties behind the challenge have the legal right, or “standing,” necessary to bring suit.

The initiative was immediately attacked. The major questions doctrine was cited as the reason for the district court to block the program. Under the doctrine, federal agencies cannot regulate matters of “vast economic and political significance” without clear authorization from Congress.

(Last June, the Supreme Court emboldened supporters of the doctrine by citing it in a 6-3 decision that curbed the Environmental Protection Agency’s ability to broadly regulate carbon emissions from existing power plants.)

The arguments were brought by a group of Republican states and the other by two individuals who did not qualify for the forgiveness program. Many of the conservative justices were concerned with fairness, executive overreach and the mechanics of whether states could bring their suit.

As for the payment obligations, they were set to resume last January, but the president issued an extension due to the fact that his loan forgiveness program was stalled in court.

The secretary of education had the authority to give the relief to borrowers making less than $125,000 per year in order to protect them from the financial harms of the swine flu and the inability to buy food, according to the Biden administration.

The millions of people who could have their debt forgiven was a topic of discussion at the arguments. Many of them did not have the same support lines that others did.

The HEROES Act and the Failure of the Biden Government to Act in a Court of First-Law Criminal Jurisprudence

She said the grant of authority is a central component of the HEROES Act, and that the agency didn’t rely on vague statutory language that was modest or ancillary.

She said that neither the state nor the two individuals behind the challenges have the authority to file a suit. She warned that if the justices did not hold otherwise, there would be implications going forward.

“Virtually all federal actions – from prosecuting crime to imposing taxes to managing property – have some incidental effects on state finances,” she said.

As for the states, Nebraska Attorney General Michael T. Hilgers, who is also representing Missouri, Arkansas, Iowa, Kansas and South Carolina, stressed that the Biden administration exceeded its authority by using the pandemic as a pretext to mask the true goal of fulfilling a campaign promise to erase student-loan debt.

Hilgers told the court thatCanceling student loans through a decree that extends to nearly all borrowers is a matter of great economic and political significance, triggering the major questions doctrine. There is a major question that courts assume Congress reserves for itself.

Hilgers rejected the government’s contention that the states can’t show the harm necessary to get into court. In court papers he put forward multiple theories of standing that mostly revolve around the theory that the states will lose tax revenue.

MOHELA: A State-created entity and the Biden Student Loan Explanation Program. The Missouri Department of Education and the Supreme Court

Mokela, an independent corporation, said it is not involved in the state’s challenge. One of the largest holders and servicers of student loans is a state-created entity. The state of Missouri claims that because MOHELA would lose servicing fees on federal loans that are discharged, the agency might fail to make its required payments to the state treasury.

The red states support a group of former government officials who said that Biden should not be allowed to forgive billions of dollars in student loan debt.

While the Biden administration is aggressively defending the program in court, the president did not announce the program until August 2022, and then only under pressure from the left wing of his own party.

The Biden plan, however, has not yet paid out any money because two lower courts have put the program on hold, sending the case to the Supreme Court. On Tuesday, the justices will hear expedited arguments in a challenge to the Biden plan brought by six states — Missouri, Nebraska, Iowa, Arkansas, Kansas and South Carolina.

Stephen said that he consulted informally with the White House on the case. He says the words of the statute are clear and expansive.

The secretary of education has gotten a grant of authority from Congress. The plain text of the statute is “not vague when it talks about the secretary’s power to waive or modify any statutory or regulatory provision applicable to programs like federal student aid.”

waiving or modifying loan requirements isn’t the same thing as cancelling the obligation to pay back some or all of a loan according to Jonathan Adler.

Defending a Right to Susinate: The Case for a New Law of State Superinstance in the U.S. Supreme Court

That said, the case could have an even greater impact if the justices decide that the states don’t have the right to sue at all because they can’t show they have suffered any concrete harm.

Republicans have used state lawsuits to block the policies of the Biden administration. Democrats have also used the tactic, though it has been less successful.

The numbers of these lawsuits is skyrocketing, and it is at least possible that the Supreme Court would like to see fewer of them. They have to limit the doctrine of legal standing in order to do that.

To get in the courthouse door, a state needs to show how its citizens have been harmed. The question in this case is whether any of the states have shown that.

“As a general matter, it is much harder to challenge a governmental action that does something nice for somebody else than a governmental action that harms you,” Adler observes. The states have had to be creative in ways of figuring out how to identify the impact on them from the ability to forgive student loans.

Debt Forgiveness and the Politics of the 2022 Midterm Election: Why Does Biden Really Want Debt? A Commentary on the Case for Student Loans

Professor Vladeck thinks that won’t fly. He says the Supreme Court has stated for a decade that a future injury can’t be the basis for a lawsuit.

Also likely to come up at Tuesday’s argument is the timing for student loan forgiveness. The loan program is designed to help younger people with loans who have suffered economically during the swine flu and need some loan relief. The emergency will be over on May 11, according to Biden. The administration claims that the “downstream effects” of the pandemic will nonetheless continue for quite some time after the end of the emergency. It could find some strong opposition at the Supreme Court.

Whether the debt forgiveness helped Democrats overperform in that election is up for debate, but the one-sided politics of the plan was a key sticking point for Supreme Court justices who have been skeptical of Biden’s authority to do things without congressional approval.

Those are valid questions, and the idea of debt forgiveness splits the country in half. In national exit polling conducted for the 2022 midterm election, 50% of midterm voters, mostly Democrats, approved of Biden’s debt relief plan, and 47%, mostly Republicans, opposed it.

She said that they don’t have friends or relatives who can help them make the payments. She said that the debtors would suffer in ways others wouldn’t.

Taking on debt is an investment, since graduates make more money than non- graduates. But debt can hound people for decades. Nearly a quarter of debt is owed by people age 50 and older.

Black graduates with high debt loads are less likely to take advantage of their degree and debt forgiveness is a solution to address racial inequality.

Bidens proposal is a small step, but not complete enough to address the root problem of college costs, it would only take a small amount out of the larger balance sheet.

Supreme Court Student Loan Forgiveness What Matters: What Do We Need to Know About the College Loans? A Comment from Chief Justice John Roberts

The White House tried to show that these people are from all parts of the country when it released a list of applicants.

Chief Justice John Roberts pointed out during arguments that something that’s going to affect so many people and cost so much money should, to the casual observer, come from Congress.

“And if they haven’t acted on it, then maybe that’s a good lesson to say for the president or the administrative bureaucracy that it’s not something they should undertake on their own,” Roberts said.

I have taken out a lot of loans. I’m trying to go through college without having to stress about all the payments and everything else.

“Well, what I was sharing is a story that is certainly no anomaly. The Massachusetts Democrat said that the crisis is burning people from every walk of life.

I had to take out those loans because I was growing up in a single parent household and it was difficult for me to make ends meet. I ultimately defaulted on those loans and I did pay off those loans, but it took me 20 plus years to do so. And I was gainfully employed and often living check to check and I simply could just not make ends meet. She said she couldn’t get ahead.

“And despite people’s Herculean efforts working multiple jobs, given rising costs, people are treading water. They’re treading water, and we can do something to alleviate this burden and this hardship,” she said.

Source: https://www.cnn.com/2023/02/28/politics/supreme-court-student-loan-forgiveness-what-matters/index.html

The Role of the Highest Powers in Judiciary Judgmentation: CNN Legal Analytical Report on the Second World War

CNN legal analyst Steve Vladeck, a law professor at the University of Texas at Austin, told CNN’s Kate Bolduan that if the Supreme Court grants standing to the six red states, it has the potential to open up a new era of legal challenges in which states overload the legal system with challenges to any and all presidential actions.

Does their dislike of the program lead to the decline of the historical limits on standing? That issue will need to be decided by the justices if they want this to be decided at the ballot box.

Editor’s Note: Jill Filipovic is a journalist based in New York and author of the book “OK Boomer, Let’s Talk: How My Generation Got Left Behind.” Follow her on social media. This commentary is not a commentary on her opinions. View more opinion on CNN.

The US government was set up to be separate from the president and to avoid being taken over by a king, he says.

Student Loans, Banks, and Finance: The Case Against the GOP Governors that Sustained a High-Lower Court Injunction

This case may fall apart before the judges even get to the meat of it, because of the issues with the other side. In order for a court to hear a case like this one, the individuals or entities suing have to have suffered some actual harm – they can’t just dislike a law or policy, they have to be negatively affected by it. The Court will first have to consider if the Republican governors who are suing have met the threshold to sue in the first place.

If the Republican governors win, though, and the student loan forgiveness program is scrapped, the real losers will be indebted former students, not the GOP.

One who racked up four years of credit card debt buying cars, clothes and vacations can discharge that debt in a bankruptcy court. An 18-year-old who signed a $100,000 loan agreement at 7.5% interest because it was their only way to pay for school cannot.

But we should be concerned about overreach from a conservative Supreme Court, too, as well as a student loan system that places heavy financial burdens on young people as soon as they embark on their adult lives.

Meanwhile, the debt mountain has grown, fueled by rising tuition costs and reduced or flat investment in public universities by state governments. College debt has taken a three-year hiatus on federal student loan repayments. When loan payments come due again, some of the startups may find their moment to grow has come.

The student lending industry has gone largely undisrupted. Companies like Sallie Mae (which began as a government entity servicing student loans) and its spin-off Navient have dominated. Loan refinancers have sometimes been problematic lenders, making money off people who sought lower interest rates without understanding the fine print of loan consolidation.